System understanding of the market, independent of emotions and subjective judgments

A multi-layer fusion structure model based on MSC × JSS, StarMatrix is capable of identifying market continuity, jump events, and structural pressures.

Newstar Asset Capital is a systematic asset management institution originating from the UK and serving the global market.

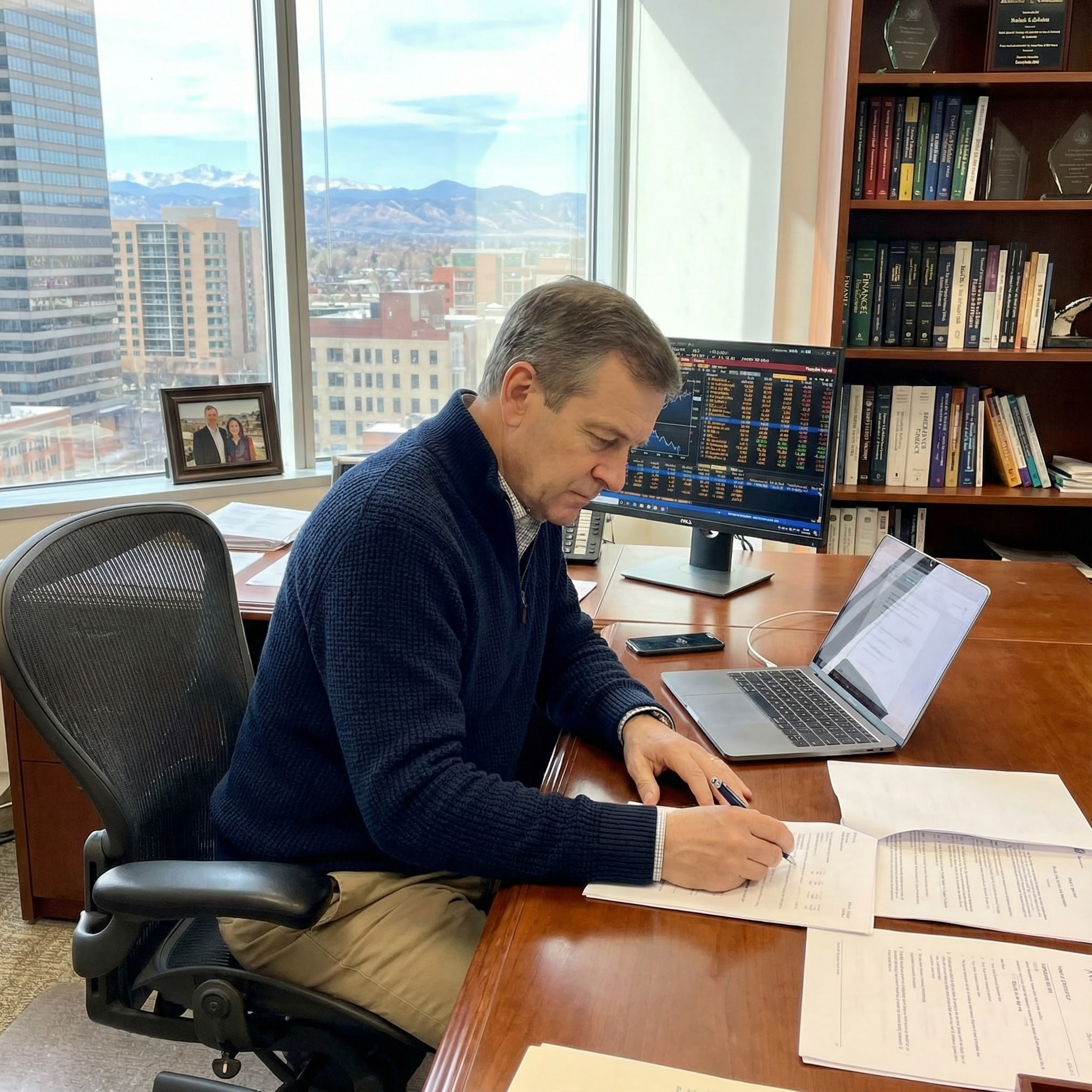

Newstar Asset Capital was co founded by two internationally renowned systemic scholars:

The proposer of the Multi Asset Cycle Model MSC and an interdisciplinary researcher from London and Cambridge.Proficient in market structure analysis, state flow modeling, and system stability research. His philosophy: "Investment is a systematic science, not short-term speculation

Propose the JSS (Jump State Spectrum Model) jump state spectrum system, focusing on market mutation structures and risk transmission pathways.Renowned for its multi asset interaction model and microstructure dynamics.

Real time recognition of dozens of continuous and jumping states to determine the market structure.

Analyze the flow direction of macro, industry, and industrial chain cycles.

Visualize market pressure, liquidity gaps, and cross asset risk transmission pathways.

Capture the dynamic changes of behavior groups such as trends, arbitrage, and speculation in different states.

Build a systematic allocation framework across assets, multiple currencies, and multiple markets. StarMatrix ™ Our mission is not to predict, but to provide a robust system chassis that is "cross asset, cross cycle, and adaptive".

The growth of Newstar Asset Capital reflects the entire process of the systemic approach from academia to global asset management practice:

Michael and Jason grew up in an engineering and mathematical environment, developing a structured understanding of the market. They proposed MSC and JSS models respectively, laying a theoretical foundation for entrepreneurship.

The two met in a quantitative closed door meeting and decided to build the next generation of systematic investment system.

Establish three major principles: Interpretable/cross cycle/system resilience priority.

Continuously iterating through data noise, jump structures, and state misjudgments, ultimately forming a complete system link.

Stable structural returns have been maintained during periods such as the pandemic, US stock market circuit breakers, and inflation shocks.

The London headquarters has been upgraded, and the New York Quantitative Laboratory and Australian Research Center have been established one after another.

Founder & Chief Architect

Newstar Asset Capital | StarMatrix Quant

NewstarAsset Capital co-founder

Senior Research & Strategy Collaboration Advisor

Newstar has established a global network in the following regions, serving institutions and high net worth clients in Europe, North America, Australia, and Asia.

London (Global Research Headquarters)

New York (Quantitative Laboratory)

Sydney (Structural Research Centre)

Singapore (Asia Pacific Operations)

Denver (North American Operations Center)

The market is unpredictable, but the system can be designed to be robust enough.

We are not betting on a single event, but building structures that can traverse cycles.

With StarMatrix™, risks become visible, quantified, and manageable